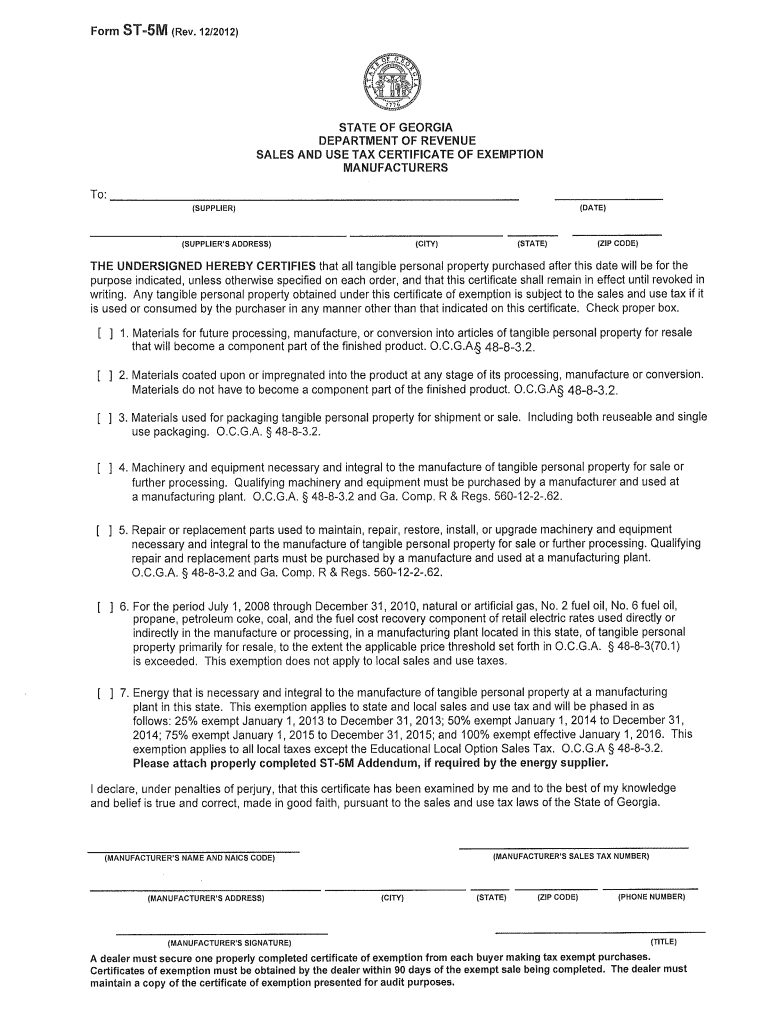

Who needs a form ST-5M?

Form ST-5M was designed for taxpayers in the State of Georgia. It is not requested from all taxpayers. Only exempt manufacturers that have a Certificate of Exemption from the Commissioner of Revenue need to file this application in order to purchase items without applicable sales taxes.

What is form ST-5M for?

Form ST-5M stands for a Sales and Use Tax Certificate of Exemption for Manufacturers. An agent representing an exempt manufacturer must provide this certificate to a goods or service provider to inform him that no sales tax should be withheld from this purchase.

Is it accompanied by other forms?

Energy suppliers may request a copy of the certificate as evidence that the manufacturer is entitled to an exemption. Certificate ST-5M may be requested by filing form ST-2M with Georgia Department of Revenue.

When is form ST-5M due?

The Sales Tax Exempt Purchaser Certificate must be presented upon making a purchase.

How do I fill out a form ST-5M?

First, write the name and address of the supplier and the date of the purchase. Check proper boxes to identify what kind of tangible property is a subject to sales and use tax exemption. It could be materials for future processing, materials impregnated into the product, materials used for packaging, repair or replacement parts, machinery, equipment, any kind of fuel or energy. Write the manufacturer’s name and address in the bottom of the page. Don’t forget to put your signature and date.

Where do I send it?

Provide one copy of the completed form ST-5M to each purchaser and maintain one copy to your audit purposes.